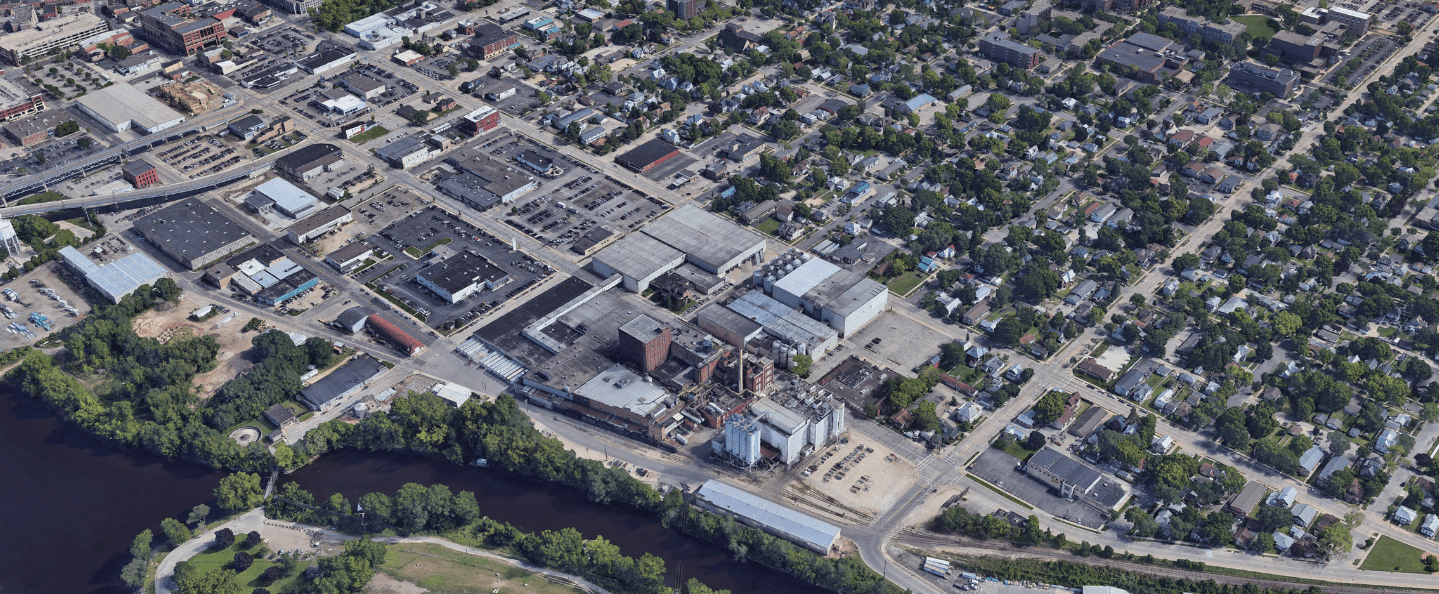

SAB Capital’s Bryan Huber and Ryan Morris structured the $60M sale leaseback of a 750,000-square foot bottling and canning plant in the Mid-West. The operator is a leading contract manufacturer of flavored malt beverages, spirit-based ready-to-drink cocktails, and other alcoholic & non-alcoholic beverages for world-leading beverage brands.

Huber and Morris ran a confidential outreach campaign that generated 12 bids in the first 14 days. With such robust buyer engagement, SAB narrowed the bidder field by instituting a ‘best and final’ deadline for the top 5 bids. On days 22 and 23, SAB hosted management meetings with the top 3 bidders, empowering the seller to select a private net lease fund as their SLB partner in 26 days.

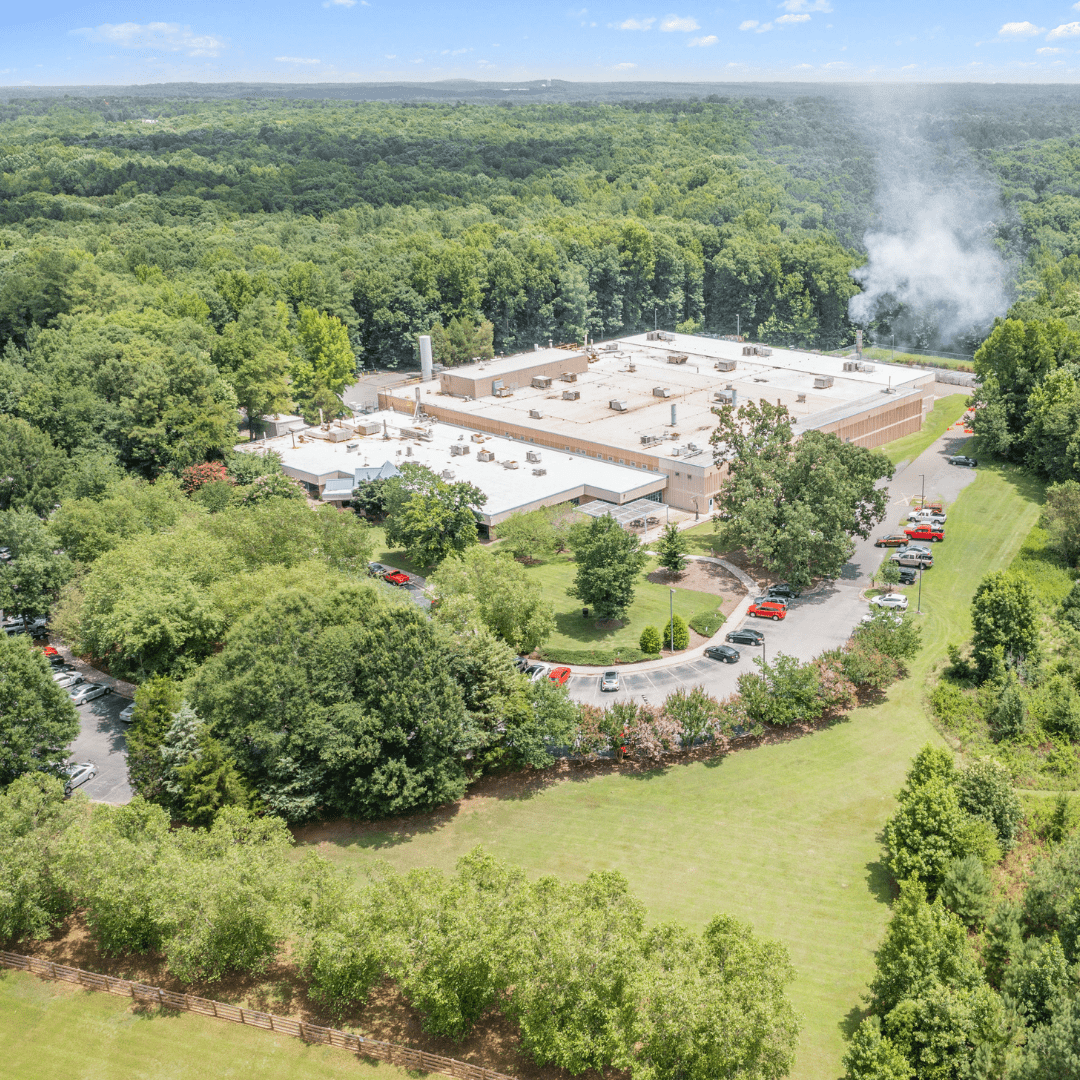

SAB’s transaction team subsequently assisted with lease negotiations, reconciling property-level diligence findings, and curing title to close the transaction 38 days from LOI execution. Proceeds from the sale will fund CapEx investments the manufacturer is making in its California plant to further the company’s west coast market share.

The SAB team had several notable victories throughout the transaction: SAB’s competitive bidding process built a market that delivered 46% more in proceeds than initially targeted by the seller. Another critical stride was getting the buyer universe comfortable with the collateral and geography. This plant is situated more than 150 miles from Minneapolis and Milwaukee and was built in stages over 150 years. Providing investors with a firmer understanding of the tenant’s credit and the property’s criticality to the tenant’s operations was paramount to execution.

For more information regarding this opportunity, please contact Bryan Huber (646) 809-8845 | bhuber@sabcap.com or Ryan Morris (646) 809-8844 | rmorris@sabcap.com