-

Take 5 Oil Change

Spring Hill, FLDominic Padula

$2,527,000CAP5.50%

Square Feet1,686

StatusAvailable

-

Circle K

Arcadia, FLMichael Grunberg , Stephen Asihene

$1,900,000CAP5.53%

Square Feet2,000

StatusAvailable

-

6230 South Ashland Avenue

Chicago, ILDominic Padula

$925,000CAP8.56%

Square Feet9000

StatusAvailable

-

90-100 Columbia Street

Quincy, MACharles Everett , Jason Grunberg , Jake Torre

$3,500,000Square Feet7,104

StatusAvailable

-

400 Park Ave & 421 High Street

Williamsport, PAGabriella Schwalbe

Square Feet136000

StatusAvailable

-

LongHorn Steakhouse

Columbus, GAMichael Grunberg , Stephen Asihene , Nick Santagata

$2,056,749CAP5.25%

Square Feet5710

StatusAvailable

-

170 35th Street

Brooklyn, NYJake Torre , Jason Grunberg

$830,000Square Feet1,295

StatusAvailable

-

Red Lobster | 2.08 Acre Lot

Augusta, GAMichael Scali , Dominic Padula

$3,057,012CAP8.00%

Square Feet7,468

StatusAvailable

-

Sunnyside Estates

Wartburg, TNJohn Snee , Lucas LaTrenta

Square Feet38,020

StatusAvailable

-

Walgreens

Colonie, NYMichael Grunberg , Stephen Asihene , Nick Santagata

$5,723,386CAP7.00%

Square Feet14,820

StatusAvailable

-

273 Meserole Street

Brooklyn, NYJake Torre , Jason Grunberg , Charles Everett

$3,500,000Square Feet6,250

StatusAvailable

-

Wendy’s

Charlotte, NCDominic Padula , Michael Grunberg

$2,665,127CAP5.50%

Square Feet3,251

StatusAvailable

-

Wellnow

Syracuse, NYDominic Padula , Michael Grunberg

$1,832,068CAP7.25%

Square Feet3,500

StatusAvailable

-

Arby’s

Pineville, LAStephen Asihene , Michael Grunberg , Nick Santagata

$1,325,404CAP5.20%

Square Feet2,100

StatusAvailable

-

Wendy’s – 27+ Year Base Term

Morristown, TNMichael Grunberg , Stephen Asihene , Nick Santagata

$2,975,000CAP5.00%

Square Feet2,320

StatusAvailable

-

Cityside I&II Apartments

Trenton, NJJohn Snee , Lucas LaTrenta

Square Feet228,554

StatusAvailable

-

3053 Atlantic Avenue

Brooklyn, NY$4,950,000Square Feet8273

StatusUnder Contract

-

255 47th Street

Brooklyn, NYJason Grunberg , Jake Torre

$6,750,000Square Feet18000

StatusAvailable

-

Tilted Kilt

Laredo, TXMichael Grunberg , Stephen Asihene , Nick Santagata

$4,000,000CAP6.75%

Square Feet7704

StatusAvailable

-

Tilted Kilt

Killeen, TXMichael Grunberg , Stephen Asihene , Nick Santagata

$4,000,000CAP6.75%

Square Feet6302

StatusAvailable

-

Applebee’s

Seneca, SCMichael Grunberg , Stephen Asihene , Nick Santagata

$3,481,097CAP7.20%

Square Feet4,933

StatusAvailable

-

Exxon Gas & Retail

Spring, TXStephen Asihene , Michael Grunberg

$3,680,000CAP7.68%

Square Feet6,369

StatusAvailable

-

177 27th Street

Brooklyn, NYJake Torre , Jason Grunberg

$3,500,000Square Feet11,000

StatusAvailable

-

10-16 S 2nd Avenue

Mount Vernon, NYJason Grunberg , Jake Torre , Charles Everett

$3,950,000Square Feet17,033

StatusAvailable

-

Scooters Coffee

Louisville, KYMark Pomella , Dave Gollenberg

$1,000,000CAP6.00%

Square Feet685

StatusAvailable

-

378 Central Avenue

Brooklyn, NYJason Grunberg , Jake Torre , Charles Everett

$1,800,000Square Feet4,125

StatusAvailable

-

CVS Portfolio

Clarksville and Winnsboro, TXDominic Padula , Michael Grunberg

$1,108,333CAP6.00%

Square Feet8,330

StatusAvailable

-

Dollar Tree

New Salisbury, INDominic Padula , Michael Grunberg

$959,760CAP6.25%

Square Feet10,500

StatusAvailable

-

Northview Gardens

Martinsville, VAJohn Snee

Square Feet75,000

StatusAvailable

-

US Bank

Cicero (Chicago), ILMark Pomella , Dave Gollenberg

$3,200,000CAP7.81%

Square Feet3,055

StatusAvailable

-

4409 New Utrecht Avenue

Brooklyn, NYJake Torre , Jason Grunberg

$3,880,000Square Feet7,762

StatusAvailable

-

550 Marshall Phelps Road

Windsor, CTCharles Everett , Jason Grunberg , Jake Torre

$16,500,000CAP8.00%

Square Feet226,429

StatusAvailable

-

BP Gas Station

Uniondale, NYMichael Grunberg , Stephen Asihene

$2,725,000CAP5.25%

Square Feet1,651

StatusAvailable

-

755 Washington Ave

Brooklyn, NYJason Grunberg , Jake Torre

$3,250,000Square Feet11,370

StatusUnder Contract

-

314-318 49th Street

Brooklyn, NYJason Grunberg , Jake Torre

$2,300,000Square Feet9,114

StatusAvailable

-

Orchard Square

Yankton, SDJohn Snee

Square Feet23,121

StatusUnder Contract

-

420 Park Avenue & 832 Kent Avenue

Brooklyn, NYJason Grunberg , Jake Torre

Square Feet12,000

StatusAvailable

-

Kohl’s

Neenah, WILuca Cobucci

$9,900,000CAP7.30%

Square Feet86,854

StatusAvailable

-

CVS

Jersey Shore, PA$4,803,751CAP5.00%

Square Feet10,125

StatusAvailable

-

CVS

Delphi, IN$3,000,000CAP5.00%

Square Feet10,922

StatusAvailable

-

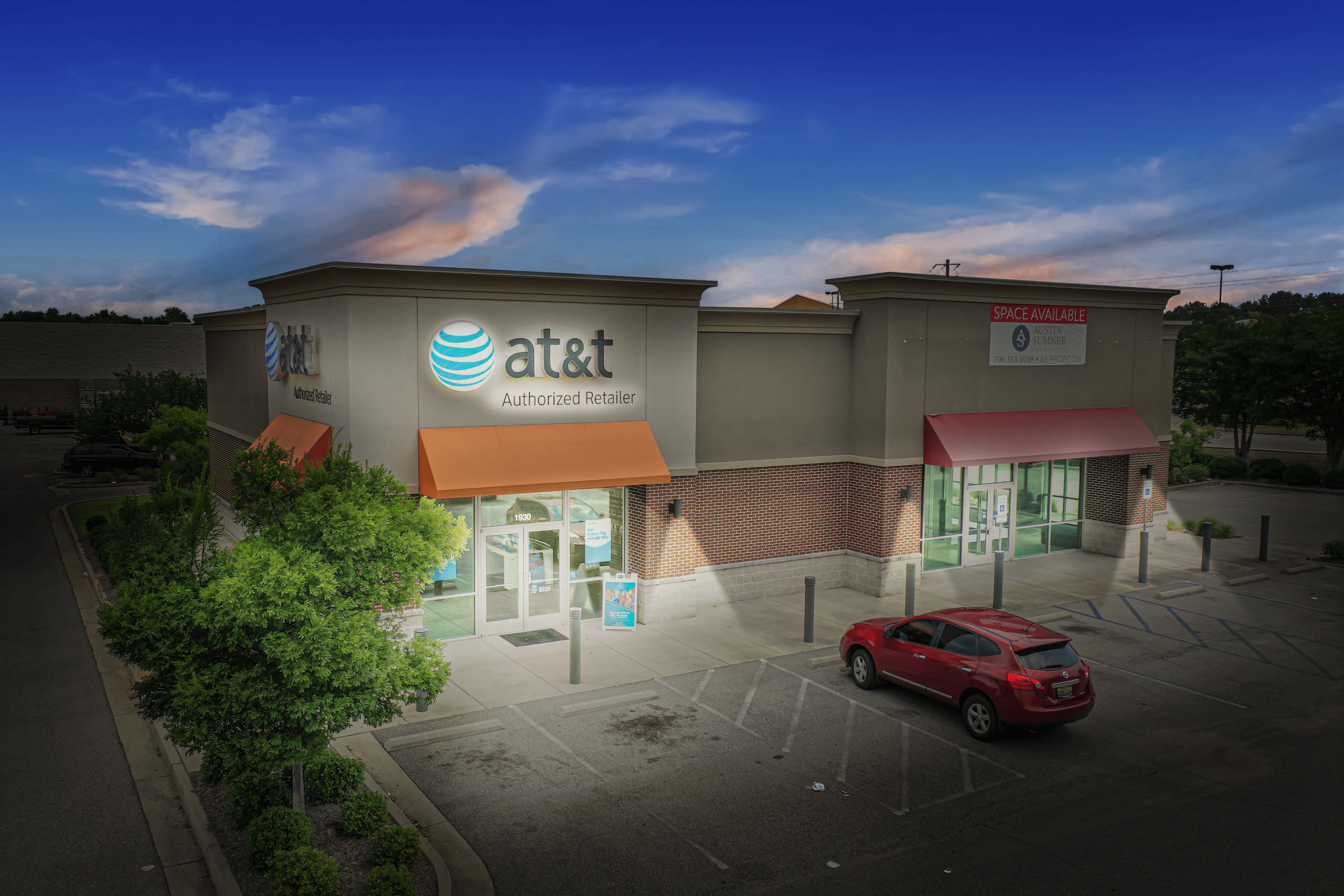

AT&T | Value Add

Montgomery, ALMichael Grunberg

$1,800,000Square Feet5,800

StatusUnder Contract

-

471 – 483 20th Street

Brooklyn, NYJake Torre , Jason Grunberg

$5,000,000Square Feet13,700

StatusAvailable

-

Valor Healthcare

Franklin, LAJenna Lustbader

$1,375,000CAP8.00%

Square Feet16,799

StatusUnder Contract